A Mobile Milestone for Christmas 2023

[ad_1]

American buyers dialed up $5.3 billion in 2023 Black Friday smartphone purchases, accounting for 54% of on-line gross sales for the day after Thanksgiving, based on Adobe.

Globally, almost 80% of all on-line gross sales happen on a cellular gadget, per Statista, primarily because of the Asia-Pacific area.

North America usually and the USA particularly have been slower to undertake cellular ecommerce, preferring the extra expansive desktop experiences, however that can probably change in 2023 — not less than for the Christmas buying season.

Cell to Move Desktop

Seemingly everybody will store on smartphones this 2023 vacation.

Adobe, which tracks vacation ecommerce spending in the USA, “expects cellular to overhaul desktop for the primary time this vacation season, with greater than half (51.2%) of spend on-line to happen on cellular.”

As proof, U.S. Black Friday cellular gross sales grew about 10.4% year-over-year. On Thanksgiving Day, usually even higher for cellular ecommerce, buyers spent $3.3 billion from cellular gadgets, a rise of 14% in comparison with 2022.

Cell Implications

The truth that U.S. buyers more and more use smartphones for purchases isn’t a surprise. The shock is that it took so lengthy. Ecommerce and retail observers have predicted the rise of cellular ecommerce for greater than a decade.

Thus it’s a very good time to replicate on broader implications for all retailers.

Cell apps. By some estimates, together with information from Sensor Tower, a market intelligence agency, about one in 5 American adults has downloaded not less than considered one of Amazon’s cellular apps.

5 years in the past, Amazon stated that 85% of its cellular buyers used the app versus the web site. Assuming the share is unchanged, we will see a right away problem for small and midsized on-line sellers.

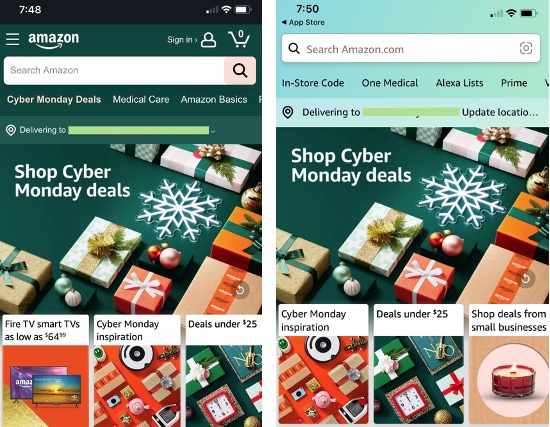

In 2018, many extra Amazon cellular buyers used the app than the web site. Listed below are the house pages of each in 2023, with the web site on the left.

As cellular accounts for a larger share of ecommerce gross sales (once more, 51.2% this vacation season) and ecommerce turns into an growing a part of complete retail gross sales (15.6% in Q3 2023), extra buyers might begin a purchase order journey on a cellular app — like Amazon’s — as a substitute of a devoted search engine.

SMBs may have to entice buyers to obtain their cellular apps or guarantee their gadgets seem in the most well-liked market apps, corresponding to Amazon, through product listings or promoting.

Conversion charges. Regardless of producing extra income, cellular gadgets have a lot decrease conversion charges.

For instance, on Thanksgiving Day 2023, desktop visits transformed at 4.4%, whereas cellular buyers transformed at 2.3%, per Adobe. On Black Friday, these charges have been 6.5% and three.2%, respectively.

So why does it take about twice as a lot site visitors on cellular to generate a sale? It’s probably the shopping experience or the context.

Closing that hole — and elevating return on advert spend — will probably be very important for retailers.

Common order worth. Cell purchases have a tendency to incorporate comparatively fewer gadgets than desktop, based on Adobe. Within the lead-up to Black Friday 2023, Individuals on common bought between 2.6 and a couple of.9 gadgets on smartphones and three.2 and three.9 on desktops.

Common order values probably comply with an identical sample. Therefore boosting cellular AOVs will probably be a precedence for retailers given the price impacts on transport, packaging, and even buyer acquisition.

Cell optimization. For years Google and different engines like google have used mobile-first indexes. So optimizing a website for cellular rankings and conversions needs to be outdated hat.

To substantiate, test your website’s proportion of traffic and conversions from cellular. Does both path the business?

A Cell Christmas

If Thanksgiving Day and Black Friday developments proceed, U.S. Christmas buying in 2023 will attain a milestone. Greater than 50% of gross sales will come from smartphones. Subsequent 12 months the share will presumably be increased.

[ad_2]

Source link