Accounts Receivable Management: 10 Proven Best Practices

Through effective accounts receivable management, a company can uphold a steady cash flow, fulfill its financial commitments, and foster the expansion of its business. Automate the accounts receivable process to expedite payments and enhance cash flow. CRM automation features such as invoice reconciliation, collection workflows, payment portals, and remittance generation can contribute to more timely payments. When a company sells a product or service on credit, it records the corresponding amount as accounts receivable on its balance sheet. However, until the payment is received, it remains classified as a receivable and does not become cash on hand. Accounts receivable (AR) management is a complex function within a business, and includes credit policies, invoicing procedures, and collection tactics.

- This policy should include all the necessary details about how you expect your clients to pay their invoices, as well as what will happen if they don’t comply.

- With the accrual accounting, you record a transaction whether cash has been received or not.

- Efficient management of credit transactions requires consistent documentation, particularly in terms of invoicing and payment flows.

- Remember, credit limits should also stay fluid and should change in reaction to the credit checks you should be performing on your customers on a regular basis.

Revenue Recognition

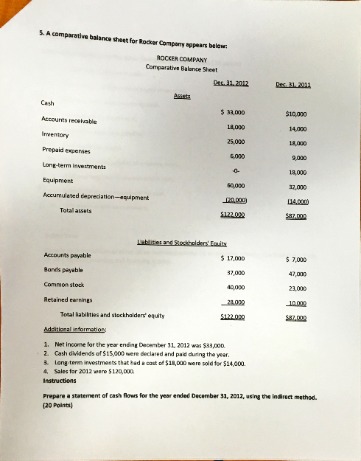

If services and money are not exchanged directly – for example in a retail shop – the company issues invoices for them and the customers owe the corresponding amounts until they have been settled. Credit cards, cash, and paper checks are no longer the only forms of customer payment. More payment methods can reduce late payments and foster a healthy cash flow. The convenience of choosing a preferred payment option takes less work for your customers than if they tried to fit a specific method. Providing a self-service payment portal in your invoice will make it even easier for them to pay on time. If takes a receivable longer than a year for the account to be converted into cash, it is recorded as a long-term asset or a notes receivable on the balance sheet.

Automate Invoicing and Payment Reminders

One aspect of your finances that needs special attention is your accounts receivable. This is because your accounts receivable is extremely crucial for any business process. By leveraging advanced automation and tracking technologies, businesses can not only enhance their receivables management but also stay agile in the face of evolving legal landscapes.

Elevate Your Accounts Receivable Process Flow with HighRadius

In order for accounts receivable management to be effective, it’s essential that you remain persistent with your debtors. It’s important to be proactive when it comes to debt collection, as opposed to reactive. This means setting strict https://www.intuit-payroll.org/top-5-reasons-why-not-filing-an-income-tax-return/ credit limits for your customers and actively pursuing payments even before they’re overdue. This policy should cover areas such as credit limits, invoicing procedures, debt collection methods, and dispute resolution processes.

What is the purpose of the accounts receivable?

Provide various communication channels for customers to connect with your team. Accounts receivable and accounts payable are two sides of the same coin, and both play big roles in your business’s cash flow. Both can help you evaluate the financial health of your business at any point in time.

What Is Accounts Receivable?

In summary, monitoring KPIs such as Accounts Receivable Turnover and Days Sales Outstanding (DSO) plays a vital role in evaluating the efficiency of a company’s accounts receivable processes. By tracking these metrics, businesses can identify areas for improvement and maintain a healthy cash flow. As a rule, accounting software can use notifications to draw attention to due or overdue receivables, for ease of management. In addition, accounting systems can often be linked directly to the company’s bank accounts and electronic account statements can be called up.

For unpaid accounts receivable, the next step would be either to contact the customer or contracting a collection agency to do so. By offering a range of payment options, you enhance convenience for your customers, eliminating the need for them to disrupt their daily routines to fulfill payment obligations. When it comes to facilitating payments, providing multiple options is paramount.

These transactions typically occur on credit, signifying that the company has granted the customer a line of credit, and payment will be made later. An aging report categorizes accounts receivable by the length of time an invoice has been outstanding. It helps businesses identify overdue accounts and assess the effectiveness of their collections process. Businesses can also improve AR efficiency by streamlining the receivables management processes. In short, AR management is concerned with expediting the process of collecting outstanding customer payments.

Accounts receivable is a current asset, so it measures a company’s liquidity or ability to cover short-term obligations without additional cash flows. When a company owes debts to its suppliers or other parties, these are accounts payable. To illustrate, Company A cleans Company B’s carpets and sends a bill for the services. Accounts receivable https://www.simple-accounting.org/ turnover is calculated by dividing the net credit sales by the average accounts receivable during a specific period. It means that your credit policies are effective and that you’re doing a good job of vetting customers’ creditworthiness. A high CEI indicates that your collections team is effective in recovering receivables.

Inefficient management of cash flow, inadequate customer support, and excessive focus on cash application can have a cascading impact on your team’s performance. Accounts receivable is one of the most important line items on a company’s balance sheet. It is money owed to a company from the sale of its goods or services to customers that has not yet been paid. The shorter the time a company has accounts receivable balances, the better, as it means the company is being paid fast and it can use that money for other business aspects. Accounts receivable (AR) is the balance of money due to a firm for goods or services delivered or used but not yet paid for by customers.

In the current asset section of its 31 January 2020 balance sheet, total receivables are listed net at $3,673 million. Accountants disclose receivables when the reporting company has the right to receive cash, some other asset, or services from another party. A well-researched set of credit limits is the first line of defense protecting your business from bad actors and delinquent customers. It can be frustrating when you’re trying to collect money from a client, and they keep putting you off or making excuses. However, it’s important to be persistent and continue reaching out until you’ve received payment.

Contingent (or potential) rights to collect may be disclosed in footnotes if they are material and if sufficient information is provided to allow the reader to understand the contingency. Explore seven transformative applications and discover how is AI used in businesses for efficiency and innovation. Additionally, you can streamline the invoicing process with meticulous attention to detail. Bank reconciliation involves managing various remittance formats, including addressing missing remittances.

Under the accrual basis of accounting, the account is offset by an allowance for doubtful accounts, since there a possibility that some receivables will never be collected. This allowance is estimate of the total amount of bad debts related disposition in commercial real estate to the receivable asset. SugarCRM provides flexible automation solutions for the management of accounts receivable. Covering invoicing, payment tracking, and customer communication, SugarCRM adapts to the unique needs of businesses.