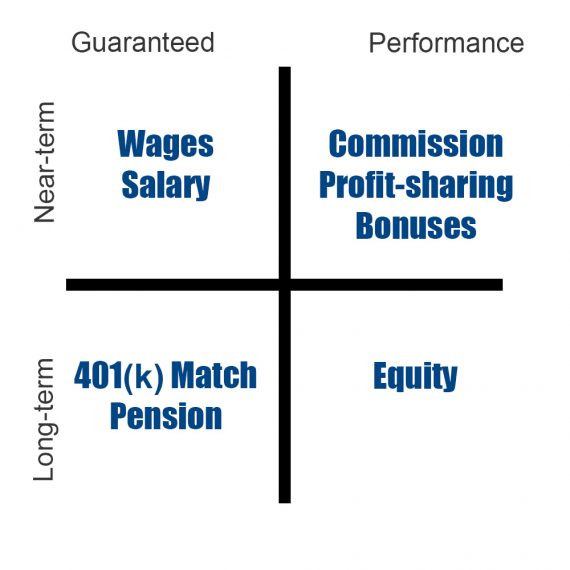

Employee Compensation Options, Near and Long-term

[ad_1]

In 2021, worker retention turned a trending matter. Firm’s feared labor shortages, and the media lined the so-called “Nice Resignation.”

Nonetheless, by the second quarter of 2022, inflation pushed inventory costs down and compelled some layoffs from public or venture-capital-funded companies. Labor demand wavered, maybe, barely.

Whatever the ebbs and flows of financial tides, companies should think about how worker compensation enriches each the corporate’s shareholders and the workers themselves.

Components for Compensation

Specializing in remuneration or financial compensation, excluding advantages and perks, one may argue that there are three important components or concerns.

- Is the compensation loved within the close to time period or long run?

- Is the compensation assured or based mostly on efficiency?

- Can the worker entry the compensation worth?

Some examples will assist to make clear these components.

Wage or Wages

Remuneration can take the type of an hourly wage or an yearly negotiated wage paid out in common installments after completion of labor.

This type of worker compensation is each assured and near-term.

The worker trusts {that a} paycheck will arrive at a delegated date. And the interval between funds is often solely per week or two.

Short-term, assured funds give staff monetary stability at floor stage. They’ve a predictable revenue to assist information their cash choices.

Efficiency-based

There are additionally some near-term however performance-based types of worker fee. Maybe, the most typical of those are commissions paid to salespeople, profit-sharing proceeds divided amongst staff, and bonuses for distinctive work and advantage.

These worker funds is perhaps added to a daily paycheck or divvied up quarterly or yearly. This type of compensation could also be thought-about near-term and performance-based.

These funds give staff one thing to attempt for and assist the enterprise rally them round set objectives.

401(ok) Matching

Firm-sponsored retirement plans are essentially the most favorable to staff when the enterprise matches the employee’s contribution.

So if somebody determined to save lots of 7% of every paycheck and place it — pre-tax — in a 401(ok) plan, the employer provides an identical 7%, successfully doubling the funding.

Good 401(ok) matching begins the primary day on the job and is directly absolutely assured and long-term. The worker can rely upon the matching however received’t take pleasure in its profit till retirement.

A 401(ok) matching plan ensures that staff can stay up for retirement and belief that they may have funds out there when they’re not working. These packages might also contribute to comparatively higher worker retention.

Pensions

The Hearst Company, a big media enterprise, is understood to have a funded and profitable pension plan for workers that started in 1967.

Within the case of the Hearst pension, staff will obtain a daily fee after retirement in proportion to their peak wage and time with the corporate.

Like 401(ok) plans, pensions present assured long-term compensation.

This type of compensation might not be as common with comparatively new companies, however many firms nonetheless use it, particularly with union staff.

Fairness

When staff share possession in an organization, they obtain long-term and performance-based compensation.

Fairness is the worth an proprietor (shareholder) would obtain if a enterprise will get offered and its money owed paid off.

The long-term nature of fairness implies that the enterprise (or a portion of it) will get offered earlier than the worker can take pleasure in its worth.

Fairness is performance-based as a result of the corporate should thrive, or no less than survive, earlier than promoting.

Lastly, fairness is an worker favourite as a result of, in some firms, it will probably make staff fairly wealthy. Think about having obtained fairness in Amazon early on.

Combining Compensation Sorts

As an organization develops its worker compensation plan, it could be good to incorporate no less than 4 kinds of compensation.

- Close to-term and assured,

- Close to-term and based mostly on efficiency,

- Lengthy-term and assured,

- Lengthy-term and based mostly on efficiency.

An organization may think about 4 kinds of compensation.

When an organization gives this form of compensation array, it’s serving to its staff discover monetary safety now and within the years to return.

Availability

A last consideration is an worker’s capability to entry worth when wanted.

Listed here are two extra examples that may assist to elucidate the benefit of creating money available to workers.

Entry Wages Now

For the primary instance, think about a brand new worker at a retail retailer. Paid an hourly wage, this particular person could possibly be amongst an organization’s most financially weak staff.

A report from LendingClub and PYMNTS estimated that 67% of American staff lived paycheck to paycheck in January 2022. If this was the case for the retail clerk described above, one thing as frequent as a minor automotive drawback could possibly be an emergency.

Too usually, this worker should flip to an virtually usurious pay-day mortgage to outlive, paying annual rates of interest as excessive as 499% in some areas.

This single mortgage could influence worker attendance and efficiency because the employee turns to a second job or gigs like Doordash or Uber to cowl the curiosity.

Some companies are serving to resolve this drawback by making a portion of a employee’s paycheck out there on demand.

For instance, the retail worker described above may be capable to entry one thing like 70% of her day by day wages an hour after a shift ends.

On this case, availability may assist a weak worker keep away from high-interest loans.

Entry Fairness

Hourly staff aren’t the one ones residing paycheck to paycheck. The identical LendingClub and PYMNTS report estimated that 48% of staff who earned greater than $100,000 per yr lived paycheck to paycheck in January 2022.

In response to the report, these staff wouldn’t be capable to cowl an emergency of simply $400.

This report implies that many salaried and highly-compensated staff have both excessive debt or excessive bills, which they could alleviate with the worth saved in fairness.

To this finish, some companies are making it attainable for workers to promote their vested choices. These gross sales may take the type of a direct buyback from the corporate or a secondary sale.

For instance, AngelList Enterprise has a liquidity product referred to as Transfers that successfully permits fairness holders to promote shares. A enterprise may schedule this form of sale each 24 months, allowing vested staff to entry the worth of their fairness to repay debt or purchase a home.

Companies that care about staff will develop compensation plans that in the end result in monetary safety.

[ad_2]

Source link