Getting Investors to Buy Your Inventory

[ad_1]

On the subject of funding stock, retail companies will be artistic, utilizing loans, bank cards, provider phrases, and even advances from household. Regardless of the methodology, elevating the cash could be a problem.

“Each enterprise must fund stock earlier than it will get the chance to earn income by promoting it, and there’s no single [funding] resolution for all corporations,” mentioned Sean De Clercq, CEO of Kickfurther, a platform that connects buyers with rising manufacturers.

Kickfurther describes these connections as consignment alternatives (co-ops) and separates what it does from different funding or crowdfunding choices. Earlier than describing these co-ops, it’s price mentioning a number of the methods retailers, direct-to-consumer manufacturers, and even client packaged items corporations purchase stock.

Funding Stock

Outdoors of financial savings, financial institution loans, bank cards, and particular person buyers, companies have alternatives for funding stock.

For instance, very small corporations primarily based in america can apply to Kiva for interest-free loans of as much as $15,000 and take as a lot as three years to pay.

Indosole, a model that sells sneakers created from recycled tires, is one in every of many corporations that has used Kiva for funding. Kiva companions with establishments to offer interest-free, small enterprise loans. Kiva and its companions additionally present non-financial assist and assets to assist companies succeed.

Indosole is a featured enterprise on the Kiva web site. Kiva companions with establishments to offer interest-free, small enterprise loans.

Though not-for-profit lenders comparable to Kiva are uncommon, they do exist. The Accion Opportunity Fund is one other instance of inexpensive financing.

As a retailer grows and its stock ranges improve, different types of financing grow to be out there from companies comparable to Kabbage, BlueVine, Clearco, OnDeck, or related. These corporations supply varied types of time period loans and features of credit score that established companies can entry. For probably the most half, lenders on this class will consider a enterprise primarily based on credit score historical past and historic and projected income and money circulate.

Crowdfunding Stock

One other various for some companies is crowdfunding. Crowdfunding platforms are, in a means, the Airbnb or Uber of retail or direct-to-consumer stock.

Airbnb, for instance, doesn’t personal rental properties; it merely connects of us who do with others who desire a short-term rental. And Uber doesn’t personal automobiles essentially. Slightly it connects of us who do with others who desire a experience.

Equally, crowdfunding platforms join companies with backers.

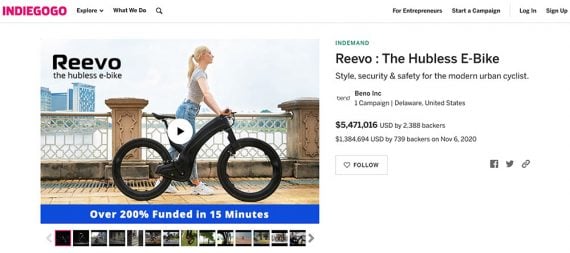

For instance, electrical bike maker Reevo raised tens of millions on Indiegogo, successfully promoting pre-orders to prospects who, in some circumstances, will wait a 12 months or extra to obtain the bike.

Reevo raised funds on the crowdfunding platform Indiegogo.

Consigning Stock

Maybe the least mentioned possibility for funding inventory is consignment and even crowdfunding consignment.

“We’re particular to physical-product corporations, which supplies us the power to have a look at issues like manufacturing and distribution threat. As a result of we’re very particular to that area of interest, we’re additionally in a position to get our companies funded for much less,” mentioned Kickfurther’s De Clercq throughout a dwell interview with the CommerceCo by Practical Ecommerce neighborhood on July 15, 2021.

Kickfurther evaluations companies earlier than permitting them to current their co-ops on the platform. As soon as authorised, funding often comes rapidly. Kickfurther buyers can assist entrepreneurs and earn a return with consignment alternatives. Fractional funding begins at simply $20.

On the time of writing, not too long ago funded co-ops included drink maker Better Than and attire model Home of Fluff.

Stock consignment is just not new. Contemplate the Winmark Corporation. The corporate owns a number of nationwide second-hand retail manufacturers, together with Play It Once more Sports activities, Plato’s Closet, and As soon as Upon a Baby. Every of those obtains stock from retail consignment: People drop off second-hand items, and the shops pay these people when the product sells.

Kickfurther applies this concept to ecommerce corporations.

Profit to Traders

In a technical sense, “As buyers, we take possession in [inventory] and consign it to the corporate to promote on our behalf, and once they promote it, then the underlying money will get distributed,” mentioned Michael Fox-Rabinovitz, managing associate of Chartwell Capital and the creator of “Own a Fraction, Earn a Fortune.” Fox-Rabinovitz invests by means of Kickfurther and likewise joined the CommerceCo neighborhood throughout the dwell interview.

“Realistically, we take a look at the deal. If we prefer it, we’ll allocate money to it…it’s actually fractional possession in a way,” Fox-Rabinovitz mentioned.

However at the very least some buyers don’t essentially take into consideration the Kickfurther co-ops on this means.

The buyers inject cash into an organization that’s each fascinating to them and a sound funding. They revenue from supporting a rising enterprise that develops thrilling new merchandise.

[ad_2]

Source link