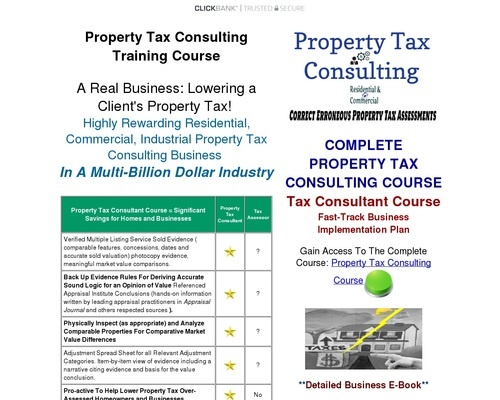

Property Tax Appeal Course for Residential and Business Real Estate

Product Title: Property Tax Attraction Course for Residential and Enterprise Actual Property

[ad_1]

All orders are protected by SSL encryption – the very best trade customary for on-line safety from trusted distributors.

Property Tax Attraction Course for Residential and Enterprise Actual Property is backed with a 60 Day No Questions Requested Cash Again Assure. If throughout the first 60 days of receipt you aren’t glad with Wake Up Lean™, you may request a refund by sending an e mail to the tackle given contained in the product and we’ll instantly refund your complete buy value, with no questions requested.

Description:

Decreasing Your or a Shopper’s Property Tax!

Additionally Is A Extremely Rewarding Residential, Business, Industrial Property Tax Consulting Enterprise

In A Multi-Trillion Greenback Business

(Click on Right here) Entry Property Tax Marketing consultant Residential & Business Programs

Utilizing Right Actual Property Market Valuation for residential and industrial companies must appropriate egregious over-assessed properties and tax overpayments resulting from

defective municipal assessments.

Assist others to not over-pay, simply pay the correct property tax evaluation that they need to be charged. Your future purchasers are being squeezed sufficient, they need to NOT overpay! Specialists inform us that over-assessed properties excesses vary from 40% to 60% (click on underlined for verification).

It is possible for you to to present near-certainty steering to purchasers with the intention to pay precisely what they need to be charged, NOT OVER-PAY!

It is step-by-step and you’re inspired to tackle circumstances from the very starting so you will earn as you apply these particular changes to a specific consumer.

With simple to grasp coaching, it is possible for you to to assist purchasers decrease their tax and set their report straight. Within the means of serving to the consumer, you earn sizable commissions. Excellent news:purchasers are simple to search out!

Home-owner’s (and companies) after they get their tax invoice are sometimes taken again by the quantity charged! The very fact is: Most DON’T KNOW that they’re over-charged!

The over-assessed desperately want a Property Tax Evaluation Evaluate Service that has their again!

It helps clients who’ve a tax-reduction case shave-off critical amount of cash off their tax invoice. Any consumer who’s suspicious of their property tax welcomes your assist.

Consider the Residential and Business Property Tax Discount Enterprise and Earn Charges with Your First Shopper

A rising numbers of house owners and companies will doubt the accuracy of their assessments and want to attraction their property taxes!

Rectify a tax injustice and provides the client the property tax break they deserve. In flip, you’re rewarded out of that tax discount by the use of a contingency payment that may carry over into subsequent years. Moreover feeling nice about serving to others, that is extremely profitable.

This contingency carryover means you are rewarded a number of instances for a similar hours of labor. Moreover getting rewarded monetarily, you’ll get pleasure from serving to your consumer out of an unfair evaluation jam. Take a look at the method!

Extraordinarily Helpful Free home appraisal and property tax attraction varieties. The varieties are PDF downloadable and supply a generic template to prepare your info in an appropriate format so you may current your proof in good type. It’s just like that utilized by licensed actual property appraisers. You may be given the password to entry this info shortly after your order.

Invaluable Pattern Payment Settlement Kinds, Fill In Payment Settlement Type, Pattern Advisor/Company Authorization Type, Fill In Advisor/Company Authorization Kinds, Residential Solicitation Letters, Signed Contract Transmittal Letters, Thank You For Selecting Our Firm Letters,

Restricted Energy of Lawyer Type, We Have Filed Your Attraction Letters, Bill Type For Companies Rendered, Enclosed Is Your Bill Letters, Previous Due Discover Letters ….

Invaluable That is the ins and outs for making this enterprise work. All of the strategies, recommendation and ways you will must fast-track this enterprise. You learn to arrange your enterprise and learn to go about advertising and marketing your enterprise to an enormous inhabitants of potential purchasers.

Invaluable Preserve your self up to date with the most recent analysis and property tax attraction recommendation for all times.

Bundle #5

Persuasion Techniques & Persuasive Salescopy E-book 110 Pages …

Helpful The Energy Of Phrases Can Make You Wealthy. If you cannot persuade folks to purchase your merchandise, you are going nowhere. Ever assume that perhaps that lacking piece is realizing how you can write persuasive copy to your clients? May the one factor standing between you and a a lot bigger success be simply good advertising and marketing copy? (click on enterprise gross sales letters and duplicate writing for extra detailed info)

Achieve Limitless Shoppers – Earn Limitless Charges!

THE COMPLETE PROPERTY TAX CONSULTING COURSE

Property Tax Marketing consultant Residential & Business Programs

Quick-Observe Enterprise Implementation Plan

Achieve Entry To Full Programs for Residential & Business Property Tax Attraction: Property Tax Consulting Course

**Detailed Enterprise E-Ebook**

Free Actual Property Market Valuation & Property Tax Marketing consultant eBook Enterprise Overview Information

Click on Beneath To Entry:

FREE Property Tax Marketing consultant Course & Enterprise Plan

**Detailed Begin Up Enterprise E-Ebook**

Residential/Business Property Tax Consulting Course

The place You Will Earn as you Study

Click on Beneath for FREE Overview eBook.

A Skilled Earnings On Your Phrases

It’s good to maintain pleasant relations with the tax assessor since one can

re-appeal their case as usually as is important with new proof any time

throughout the yr and win. That case is usually a residential or industrial

property tax attraction.

HELPING OVER-ASSESSED VICTIMS

Put together for these months. EXTREMELY PROFITABLE since few if any property tax guide specialists seemingly work inside your zip code.

COMPLETE PROPERTY TAX CONSULTING COURSE

Tax Marketing consultant Course a Quick-Observe Enterprise Implementation Plan

Achieve Entry To The Full Course: Property Tax Consulting Course

100% newbie pleasant – no tech abilities or expertise wanted.

Financial institution 4 figures in contingency commissions per attraction even if you happen to’ve NEVER made a dime consulting.

The simplest & FASTEST technique to earn contingency commissions serving to the over-assessed.

EARN as you study property tax attraction consulting.

Set your individual contingency charges.

Get Full-Entry to a foolproof turnkey system on how you can Efficiently Attraction Property Taxes and money into the cash virtually each single time you tackle a consumer.

Taking the Property Tax Marketing consultant Enterprise Course will show you how to learn to dominate an trade With Little to No Competitors.

Uncover how you can earn massive contingency charges, even one-time equalization processing charges from prospects and get Multi-Referrals.

Incomes LARGE FINANCIAL REWARDS studying as you go by a step-by-step course of & constructing a Property Tax Evaluate Enterprise.

Incomes seemingly a number of thousand {dollars} on every prospect by merely partaking on their behalf in a property tax attraction.

I graducated with a level in Actual Property (Japanese Michigan College) and this course was a fantastic Actual Property Appraisal course, higher than in Faculty.

Bought your Property Tax Marketing consultant course final yr and simply as you predicted we’re properly in our technique to a wholesome six determine revenue. My companion and I created a CRM utility (JASO)- to course of our pipeline in a seamless style (from consumer consumption to productiveness evaluation) – this databases has been key to us in touching base with our clients on a well timed method in addition to organizing each aspect of our enterprise – we see the worth that JASO has been for us and acknowledge how precious this might be for different Property Tax Consultants alike.

At the moment the appliance is tailor-made for Florida nonetheless we’re updating and customizing the CRM utility to be related nationwide. We might like to market our product to your distribution listing; if we might communicate extra in depth on the subject, I consider we are able to come to an understanding that’s worthwhile for all events concerned, I sit up for listening to from you quickly. Have an exquisite day and a pleasing weekend.

Sincerely, Michelle M

Sincerely, Michelle M

Charges are charged on a contingency foundation, which suggests, if you happen to lose the case, the consumer dangers nothing. Since there isn’t any danger to the consumer or home-owner, they need your service. Discovering potential purchasers is mind-blowing easy. Some cost an up-front session payment. Many do.

Principally, the true property appraisal system is rife with errors. Valuations are always in flux and the tax assessors workplace not often does private valuation visits. They depart it to different blanket assessor companies. That is simply the tip of the iceberg and it opens the door for a enterprise alternative that basically helps others in a significant method.

When a valuation for an jurisdiction is required, the city units out on a public bid and usually the bottom bidding property valuation dealer wins. You may wager your backside greenback that the dealer who received the bid must make a revenue.

Little money and time is allotted on a per unit foundation for the appraisal. Generally a uncooked crew is doing the work. There are time restraints on his crew to ensure that the mass evaluations dealer to earn his revenue. Errors are rampant. Due to this fact a dire want for interesting over-assessment errors.

Serving to owners in addition to industrial accounts decrease their property tax is a respectable enterprise that generates monetary rewards.

At the present time, those that can use some further revenue can work this service as a work-from-home primarily based enterprise or an add on part-time enterprise.

Since there isn’t any free lunch, it may be labored along with one other revenue stream such because the mortgage brokerage commerce, actual property, insurance coverage and comparable consulting industries. It may be labored throughout sluggish instances or simply to do one thing difficult and totally different to assist flip the desk by serving to appropriate regulatory errors.

Residential property tax attraction alternatives abound. You may discover you will by no means run wanting discovering unhealthy assessments to appropriate to not point out these referrals seeking to scale back their property tax over evaluation.

Professional research point out that the proportion of evaluation error exist is excessive. It is clear as a bell that you’re going to by no means lack purchasers.

So long as property taxes are levied and that actual property market valuations fluctuate, you will discover an over-abundance of circumstances the place the evaluation valuation in opposition to a house owner is flat out fallacious. Championing that tax attraction is a chance to be of nice service.

The larger the tax invoice, the better the reward.

The industrial aspect of the enterprise offers with bigger properties and, evidently, bigger commissions. Business valuations are primarily based on an Earnings Method. In the event that they earn much less internet revenue than the earlier yr, their property tax evaluation ought to be much less. You may study concerning the alternatives that exist on this space of specialization.

Strip malls missing tenants could must attraction an outdated evaluation. House home and complexes vacancies, many small to medium companies that is likely to be struggling might file appeals when the info warrant. Once more, a enterprise valuation relies not on a Market Worth Method however on an Earnings Method.

Truth is, in contrast to residential properties which use a comparable property strategy, a industrial property valuation is made on an revenue foundation. And guess what? If money circulate to the industrial property is missing enterprise or tenants, you might need discovered a consumer who might use vital financial savings!

Give others the tax break they deserve. Present a service the place practitioners are scarce and the outcomes are precious.

THE COMPLETE PROPERTY TAX CONSULTING COURSE

Property Tax Marketing consultant Residential & Business Programs

Quick-Observe Enterprise Implementation Plan

Achieve Entry To The Full Programs for Residential & Business Property Tax Attraction:

Property Tax Consulting Course

100% Iron Clad 56 Day Cash-Again Assure

If inside 56 days, you evaluate the whole Property Tax Marketing consultant bundle, and you are feeling this doesn’t do all that we mentioned it could do for you and extra, merely contact us and we’ll course of your refund. It is that straightforward. That’s proper, if you happen to assume the Property Tax Marketing consultant bundle doesn’t dwell as much as your expectations, you received’t be out one crimson cent! Ship us an e mail and we’ll refund your buy…

As soon as one has a consumer the subsequent step is to search out comparable properties with an identical footprint that offered just lately. The most effective and quickest and free place for that’s via the A number of Itemizing Service SOLD listing from an area actual property company. Their laptop will spit out 10 or extra comparable properties. Then cherry choose the most effective 3. On-line, in most cities, one can entry the property report playing cards getting precise recorded particulars (the place one may discover recorded info to be in error). Then it is simply placing gathered info collectively to make your case.

Your first Assure: You will have TWO full months to look at every part, use what you want, and, if for any purpose and even no purpose, you need a full refund, simply return every part and you will get your a reimbursement instantly. NO questions requested. You don’t want a ‘my canine ate my homework story’. Nobody will ask you any questions in any respect. No trouble. No ‘tremendous print’. Easy and easy; you’re thrilled with what you get otherwise you get a full refund. I am dedicated to the aim of solely having glad clients. When you’re not going to revenue from having my System, I actually would favor to purchase it again.

My sole objective in providing this course is for bringing social justice to these over-assessed. To appropriate wrongs. Many tax assessors view their job as preserving the tax base and will not be pro-active in serving to over-assessed victims. The very fact is that over-assessment errors are extreme and must be addressed. Evaluation bureaucrats must be proven the info and in the event that they flip a blind eye, there are two extra avenues of attraction: The Municipal Attraction and the State Attraction. We’d like activists who will rise up in opposition to the bureaucrats and with the precise proof, you’ll win.

I need you to place a whole bunch of 1000’s of {dollars} into your checking account in the midst of the subsequent ten or twenty years with this skilled Property Tax Consulting Dwelling Consulting Course.

(Click on Right here) Entry Property Tax Marketing consultant Residential & Business Programs

FREE Tax Consulting E-Ebook Overview Explains:

Explains how utilizing in addition to offers the Proper Kinds and Advertising and marketing Instruments making signal ups simple and the method virtually Formulaic.

Scan the FREE E-Ebook. The E-Ebook covers each residential and the industrial aspect of property tax appeals. You may study concerning the ins and outs of this little identified make money working from home consulting enterprise observe. It is without doubt one of the prime make money working from home enterprise concepts value exploring. This can be a service that many owners and companies desperately want.

It may be extraordinarily profitable to have interaction in all sorts of appeals, each residential and industrial property tax appeals.

Particulars on Every thing: Errors throughout the evaluation system provide a chance to place a big quantity of {dollars} again into your purchasers pockets. You assist help the true property taxpayer’s backside line.

With out additional ado, the components wanted to arrange profitable residential property tax appeals & many sorts of industrial property tax appeals and how you can market this sort enterprise are defined. Nothing held again. Or, if you happen to’re able to Achieve Entry To The Full Course: Click on: Property Tax Consulting Course

For a restricted time, we’re providing this free report. Since this might be one thing you is likely to be keen on discovering and looking out into additional … click on under to get a deeper look into the Property Tax Consulting Enterprise.

Property Tax Consulting 100% FREE Enterprise Plan E-Ebook

Get the FREE Obtain to see what some common attraction discount ranges are and an summary of this type of enterprise alternative.

Give others the tax break they deserve and uncover a service that the place practitioners are scarce.

<-- An over-assessed property taxpayer who didn't attraction his property tax ... years down the street!

The distinction somebody with property tax guide coaching might make for others is astonishing!!

Why Develop into A Property Tax Marketing consultant? First off, you will by no means lack for enterprise – there are quite a few incorrectly assessed properties and an excessive amount of for anybody to deal with.

Hundreds of thousands of property house owners want this service. Estimates for incorrectly assessed properties vary from 40% to 60% usually resulting from sloppy authorities guided evaluation procedures or simply rolling over earlier assessments.

It is not very difficult to study and could be labored as a make money working from home enterprise. Fifth grade math (addition, subtraction, a bit of multiplying and division), sixth grade English abilities. The logic speaks for itself.

With numerous houses and companies having evident property evaluation errors, honing in on good candidates for high-percentage, excessive greenback quantity wins shouldn’t be tough.

Property Tax Consulting Course

100% GUARANTEED To Work!

Click on Beneath for FREE Overview eBook.

Free Described Property Tax Marketing consultant eBook Enterprise Overview Information

Click on Beneath To Entry:

RISK STATEMENT: I’ve not heard or seen any property taxes raised due to an unsuccessful attraction, nonetheless that doesn’t preclude that chance.

The prospect of successful a property tax attraction utilizing confirmed adjustment strategies, proof and customary adjustment parameters drastically enhance successful that attraction. However, there isn’t any assure of a win.

The tax assessor has the ability to cut back your or your consumer’s property tax primarily based on the proof offered. One can reschedule conferences with the assessor as mandatory with the intention to show your changes for a decrease tax. If the tax assessor does not scale back the tax, the subsequent avenue of attraction is to the Municipal Courtroom of Appeals. If that fails, the ultimate avenue of attraction is the State Tax Courtroom which seemingly meets on the county degree.

Once more, no assure, but when your proof is sweet, and is smart, it’s best to win your case each time.

LEGAL: Whereas it has been confirmed by a lot of our clients that you would be able to generate revenue in a short time with this info,

please perceive that what you’re shopping for is the truth is INFORMATION and never a promise of riches or monetary acquire.

What you do with this info is as much as you.

Contact Data:

George Evers

47 Sachem Street

Lake Hopatcong, NJ 07849

862-400-5455

Property Tax Marketing consultant Dwelling Enterprise Dwelling Web page

Contact | Privateness Coverage | Phrases Of Service | Disclaimer | Earnings Disclaimer

Query and Solutions about this consulting enterprise Dwelling Enterprise Q & A

State Dates | Enterprise Letter | Dwelling Enterprise Alternative Press Launch

Dwelling Companies | Claims Processing Judgment Restoration Enterprise

working at residence | Classes of Tax Consultancy | Actual Property Enterprise Concepts

Digital Appraiser | Property Tax Consulting Overview | Property Tax Consulting Course | Business Property Tax Consulting Course

Small Enterprise Proprietor | On-line Tax Programs | Consulting | Professional Witness Testimony | Property Tax Course | Property Curb Attraction | Areas For Tax Changes

Property Tax Attraction Changes and Programs

Property Tax Attraction Enterprise

Be aware: So far as identified, the state of Texas is the one state within the union the place a license is required to have interaction in property tax consulting. See Texas Division Licensing Regulation

Work From Dwelling Companies – Begin Your Dwelling Base Enterprise … On-line Tax Course: Property Tax Consulting Dwelling Enterprise Bundle

© Copyright – PropertyTaxConsult.com – All Rights Reserved

//

[ad_2]

All orders are protected by SSL encryption – the very best trade customary for on-line safety from trusted distributors.

Property Tax Attraction Course for Residential and Enterprise Actual Property is backed with a 60 Day No Questions Requested Cash Again Assure. If throughout the first 60 days of receipt you aren’t glad with Wake Up Lean™, you may request a refund by sending an e mail to the tackle given contained in the product and we’ll instantly refund your complete buy value, with no questions requested.