Save Money on Inventory with EOQ

[ad_1]

A manufacturing scheduling mannequin first proposed in 1913 and popularized within the late Nineteen Eighties might assist fashionable firms perceive how a lot stock to purchase and the way usually, saving cash within the course of.

Ford Whitman Harris, an American manufacturing engineer, developed the financial order amount (EOQ) mannequin to assist consumers at manufacturing firms perceive how a lot of a given uncooked materials or half they need to purchase.

Up to now few a long time, differing types of firms, together with pure ecommerce operations, omnichannel retailers, and direct-to-consumer manufacturers, have used the EOQ to calculate the best quantity of stock to buy from a specific provider to reduce the price of shopping for and holding.

The mannequin begins with an understanding that the full value of shopping for stock is the sum of the acquisition value (the worth of the product), the ordering value, and the carrying value.

Complete Price = Buy Price + Ordering Price + Carrying Price

A Balancing Act

Buying stock is one thing of a balancing act.

Shopping for too little stock leads to out of shares, disappointing buyers and foregoing earnings.

However an excessive amount of stock is an issue too. The place will the retailer put the stock? And what occurs to that stock because it ages? Will it spoil or grow to be out of date?

This balancing act is what the EOQ tries to unravel, utilizing an equation that identifies ordering value, demand, and carrying value.

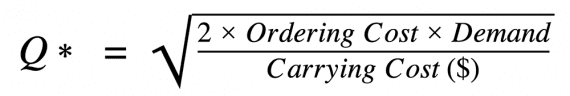

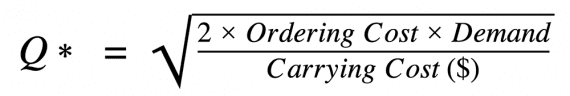

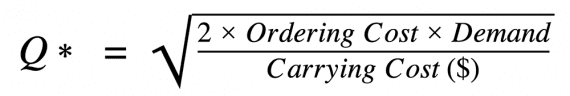

The financial order amount or optimum order dimension is the sq. root of two instances the ordering value instances the demand for a given timeframe divided by the carrying value per unit.

Ordering Price

Ordering value, additionally referred to as the setup value, is the expense of putting an order (not the worth of the products, which is the acquisition value).

Thus, ordering value would possibly embody freight and the time your organization’s buying group spends researching and putting the order.

For instance, think about a DTC model that manufactures its product in Taiwan. With every manufacturing run, the model sends a high quality engineer from its workplace in Los Angeles to the ability in Taiwan. The journey is a part of the ordering value.

On a smaller scale, a buying agent would possibly submit an order, prepare the freight, and allocate that stock to a couple warehouses. The agent’s time needs to be used to estimate a set value per order.

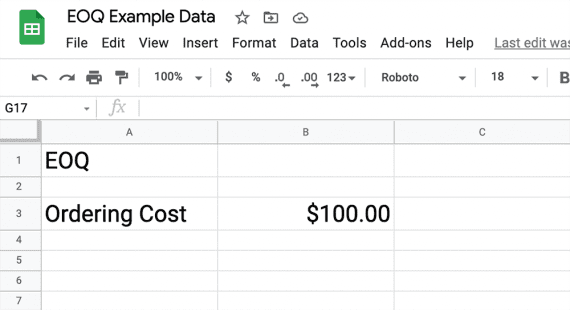

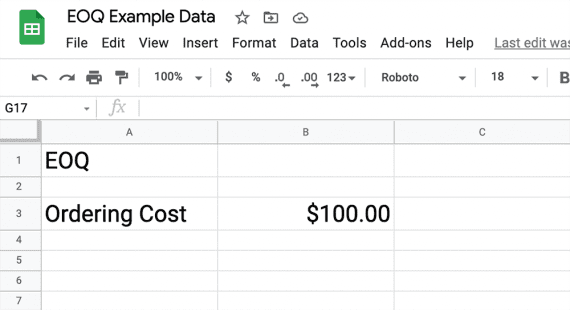

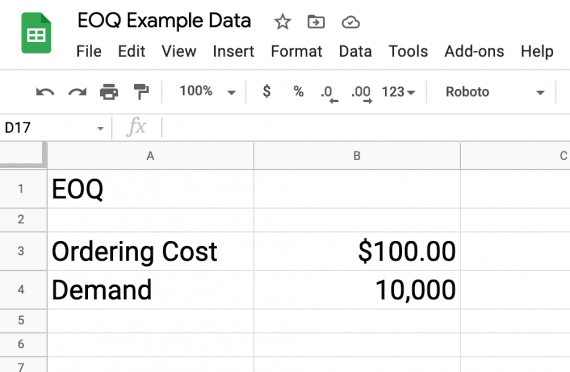

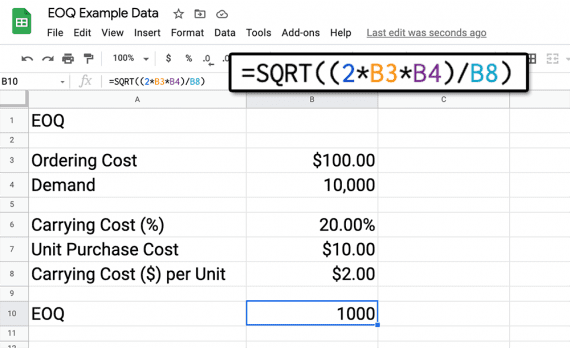

Think about that the ordering value of a product is $100. We will place this quantity in a Google Sheet.

Ordering value is the price of putting or processing an order.

Demand

For the EOQ equation, demand is the variety of items your corporation will buy in a given timeframe, sometimes one yr, reflecting the variety of items you anticipate to promote.

A weak spot of the EOQ mannequin is that it doesn’t account for seasonal spikes in demand. For that reason, it might be vital to regulate the timeframe.

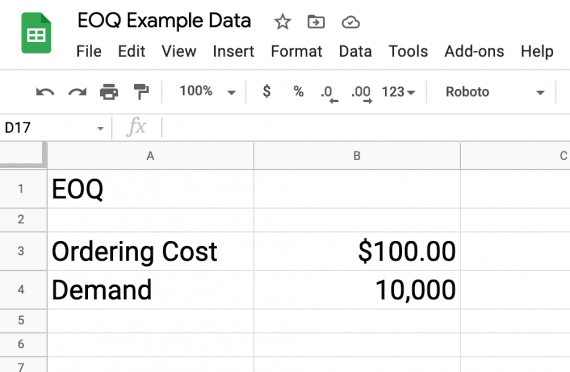

In our instance, let’s think about that demand is 10,000 items per yr.

The EOQ demand is the variety of items your corporation will buy for some timeframe, equivalent to one yr.

Carrying Price

Carrying value, which is typically referred to as holding value, is the expense of storing or holding unsold stock for a specific timeframe (the identical timeframe as for demand).

Carrying value is usually proven as a share of whole stock worth. However for our EOQ equation, we wish a financial quantity per unit. So we are going to begin by calculating the carrying value share after which multiply it by the unit value.

Stock carrying prices sometimes embody the prices of capital, storage, servicing, and danger.

- Capital prices are the chance or curiosity prices related to shopping for stock. Think about you purchased $100,000 in stock. If your corporation might have earned 5 % by investing that cash, the capital is costing 5 %. Equally, if it’s a must to borrow to purchase stock, the curiosity is a capital value.

- Storage prices are a product’s share of warehousing prices, together with the lease or mortgage, overhead, and related.

- Servicing prices are bills associated to holding a product, equivalent to insurance coverage, software program, and labor.

- Threat consists of shrinking, spoilage, and obsolescence.

Added collectively, these prices lead to “stock carrying (or holding) sum.” That determine is split by the full worth of the stock and multiplied by 100 to get a share.

Carrying Price (%) = Stock Carrying Sum / Complete Stock Worth * 100

We then multiply the carrying value share by the price per unit.

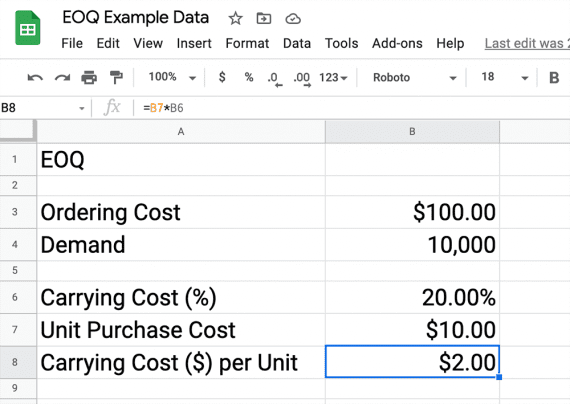

For our instance, we are able to say that it prices 20 % to hold stock and our unit value is $10. Thus our carrying value per unit is $2.

Calculating carrying value takes a bit work. It requires understanding the capital prices, storage prices, service prices, and dangers related to holding stock.

Calculate the EOQ

Having recognized the ordering value, the demand, and the carrying value per unit, we’re able to calculate the EOQ or optimum order dimension, which is Q* in our equation.

The financial order amount or optimum order dimension is the sq. root of two instances the ordering value instances the demand for a given timeframe divided by the carrying value per unit.

It is a easy calculation in Google Sheets and Microsoft Excel. The components is identical in each. Here’s what it appeared like in a Google Sheet.

=SQRT((2*B3*B4)/B8)

Calculate the sq. root in a spreadsheet.

On this case, it could take advantage of sense to order 1,000 items ten instances all year long.

Bear in mind, the EOQ goals to cut back your organization’s whole value of buying stock by calculating the optimum order dimension. EOQ then is a means to enhance your corporation’s backside line.

EOQ could also be finest for merchandise with comparatively secure demand. In case your items have sturdy seasonal demand, contemplate experimenting with the timeframe.

[ad_2]

Source link